SAF-T, developed by the Organisation for Economic Co-operation and Development (OECD), is an international standard for the unified exchange of accounting and tax data. It has already been implemented in countries such as France, Romania and Portugal, where the standard has proven effective in improving transparency and reducing administrative burden.

The SAF-T format covers key accounting data such as complete accounting history, invoices, assets, receivables and payables, which are submitted in a standardised XML format.

In May 2025, the NRA released a draft ordinance outlining the technical specifications for the SAF-T file. The draft is currently open for public consultation and is a key document for businesses looking to prepare proactively. Access the full text here.

The implementation of SAF-T in Bulgaria

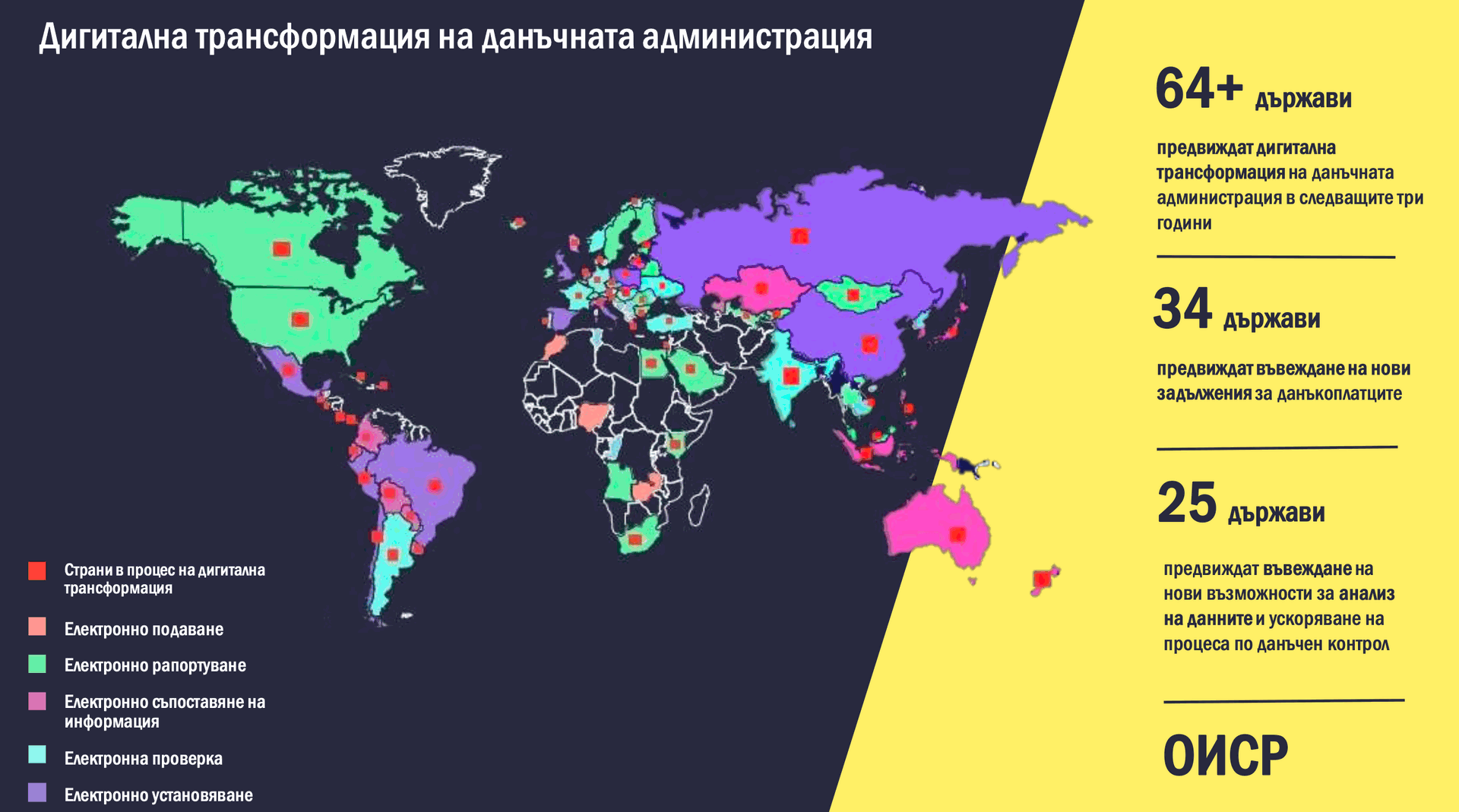

The project "Increasing voluntary compliance through the implementation of SAF-T in Bulgaria" is funded by the European Union and aims at a complete digitisation of the tax administration. Large enterprises will have to adapt by the end of 2025. Medium and small enterprises - by 2026 and 2027 respectively.

It is particularly important to underline that companies that already have integrated ERP systems in place will go through this process more quickly and smoothly. The ability to automate data extraction and structuring greatly facilitates compliance with NRA requirements - something Plan Solutions' partners already have in place.

The XSD scheme for SAF-T, adapted for Bulgaria, is based on the international standard SAF-T v.2.0 and includes local elements such as tax nomenclatures and goods movement codes. This will help businesses and administration to work more efficiently within a unified framework.

How will PLANA Solutions support clients in the process?

As a company that is closely following the development of the project, we are fully prepared to provide solutions to adapt to SAF-T:

- Integration with ERP systems: our specialists are already developing modules for automated generation and submission of SAF-T data. By remaining available to incorporate additional modules (where needed) or adjusting the current ones to meet SAF-T requirements.

- Technological adaptation: our systems are flexible and prepared to work with the XML formats that the standard requires.

- Training and Support: We schedule webinars and workshops for our customers to familiarize them with the requirements and best practices.

Need for clear regulation and documentation

We applaud the NRA's efforts to modernize tax administration and believe SAF-T is an important step toward more efficient and transparent administration. However, the success of the project depends on clear and precise regulations, as well as the timely provision of detailed documentation.

Businesses need well-defined nomenclatures, regulations, and guidelines for SAF-T file content and structure. This includes clear rules for internal data compliance with NRA requirements, as well as precise procedures for file submission, correction and validation.

Without such well-structured information, the customisation process can encounter difficulties, even for companies with integrated ERP systems. Clear and timely regulations will ensure the smooth implementation of SAF-T and ease businesses through the process of adapting to the new standard.

SAF-T is not only a technological innovation, but also an opportunity for more transparent, modern and efficient management of tax processes in Bulgaria. Our team is ready to support clients in this transition by providing innovative solutions and expert assistance.

Plana Solutions is your trusted partner in preparing for SAF-T – from strategic planning and technical assessment to practical implementation. Contact us to discuss the best approach for your organization.

Additional information about SAF-T can also be found on the NRA website.